Putting a Pin in It: The Rise of Decentralized Infrastructure Networks (DePIN) in Web3

Why you should keep an eye on DePIN

Introduction

One of the key themes in our recent piece ‘Charting the Web3 Horizon in 2024’ was the rise of Decentralized Physical Infrastructure Networks or DePIN. DePIN refers to capital-intensive infrastructure projects that use tokenization to coordinate and scale the bootstrapping phase of network development. DePIN offers a blockchain solution for real-world problems like overpriced or lagging digital infrastructure for wireless networks, computation, and energy.

DePIN operates on the principle of distributing control, decision-making, and resources across a network of nodes rather than relying on a centralized authority. This model shifts the paradigm to promote community-driven innovation instead of corporate or government driven innovation. Each DePIN network consists of an ecosystem of nodes, which could be physical devices like sensors, devices, or even entire systems! Unlike their traditional centralized counterparts, DePIN promotes local community involvement in decision-making and management but also provides other benefits: network security / resilience, decentralized control, capital efficiency, and community empowerment.

(The DePIN Flywheel, Source:@OcularVC)

Compared with centralized traditional infrastructure providers, DePIN demonstrates several advantages. Firstly, by leveraging cryptographic incentives, DePIN presents a capital-efficient way to bootstrap essential infrastructure that is traditionally capital intensive and expensive to maintain. This could also bring reduced cost to consumers. Secondly, because DePIN networks are distributed across a network of nodes, redundancy is created and ensures that even if one node fails, the rest of the system stays operational. Lastly, the community-centric approach of DePIN networks can empower local communities to manage their own networks and improve network efficiency. When decisions regarding resource allocation and maintenance can be made at the grassroots level, infrastructure is viewed from a long-term holistic benefit perspective vs just profit.

Over the past few months, we have seen DePIN network launches that have shown early signs of product-market-fit of the “sharing economy”. These projects are spread across various sectors within DePIN, each having different use cases. In this article, we will explore the state of DePIN, the issues DePIN projects are facing, and next steps for the sector to grow.

Current State of Play

Summary:

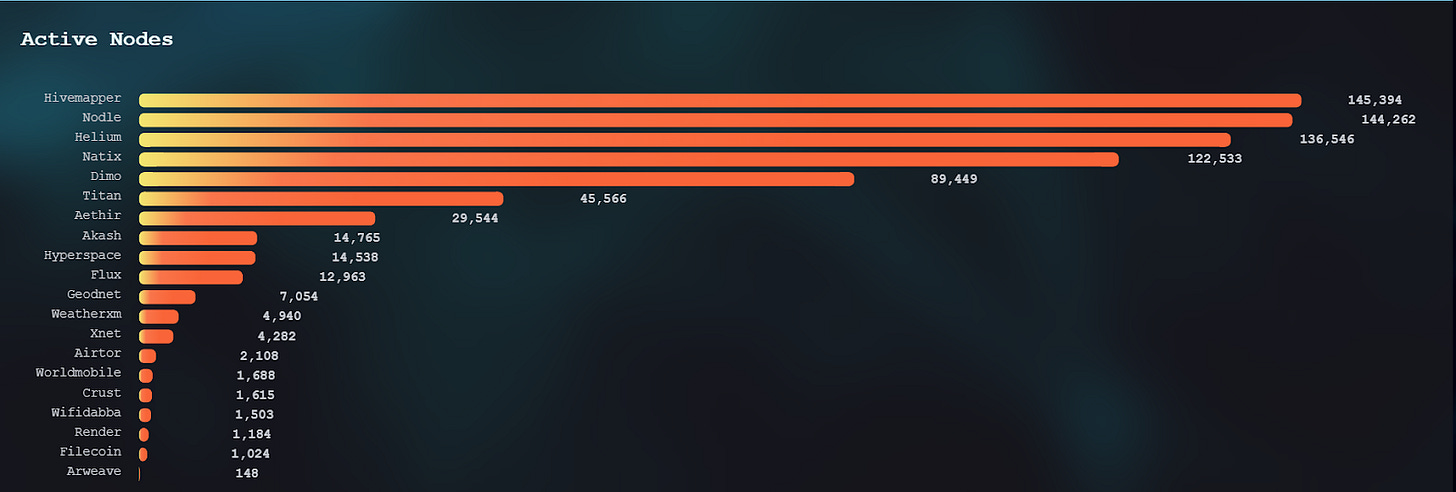

Venture funding for all crypto projects has seen a resurgence this year, with $4bn of funding invested globally as of April 2024. DePIN is on the rise, with a total of 70 DePIN projects raising a combined $192m in the same period. Key deals to highlight include io.net, a Solana-based distributed GPU project that raised $20m for its Series A at a $1bn token valuation, and Aethir, a decentralized node provider for GPU compute that raised $65m in the first hour of its node sale. DePIN projects currently have a combined market cap of over $54b- projects across sectors currently generate over $18m of annual on-chain revenues, with the likes of Filecoin, Flux, Braintrust, and Helium leading the industry. Admittedly, valuations are still very rich at 3,000x FDV / Revenues but funding continues to come in anticipation of more robust product-market-fit. The entire ecosystem has grown to over 1,220 projects with over 600k active nodes.

The DePIN ecosystem can be further broken down into 6 main categories: Compute, Wireless, Energy, AI, Services, and Sensors.

(Source: EV3, Messari, Depin Ninja)

Compute

Under this category, we include the entire compute lifecycle which needs storage, the actual compute, and data retrieval infrastructure - we will dive into each briefly to discuss their differences.

Storage

Decentralized storage infrastructure allows data to be stored across possibly thousands of different nodes vs having them all stored in web2 data center / cloud options like Amazon, Microsoft, and Google. Storage providers offer their extra space for a fee, akin to traditional data storage business models. Projects like Storj, Arweave and Sia participate in storage, but Filecoin continues to lead the industry.

(Filecoin Capacity, Source: Starboard Ventures)

The Actual Compute

Decentralized compute infrastructure is similar to data, but computational power is sold instead of storage space. This sector has taken off in recent months because of an increase in compute demand driven by AI projects. Unlike storage, the decentralized compute sector is constrained by a lack of supply. Aethir, a decentralized node provider for GPU compute, recently concluded its node sale and raised over $65m in the first hour alone. These nodes aim to provide compute capability for gaming and AI across both Web2 and Web3.

Data Retrieval

Data retrieval is concerned with pulling the stored data for ease of use. Data that is stored in a decentralized fashion requires robust content delivery networks to ease access, but the challenge is that the content delivery networks themselves are difficult to decentralize. Projects like Filecoin Saturn and Fleek are tackling this problem and have shown early signs of progress but none have seemed to crack the retrieval problem just yet.

Artificial Intelligence

The rise of AI companies has been rampant across all levels of society - DePIN provides a way for infrastructure to support the growth of AI but also a way for AI companies to monetize their models. Datasets that run computations privately can then be sold on decentralized marketplaces. SingularityNET looks to enable monetization of research and models in a decentralized fashion - its fully diluted market cap currently stands at $1.2bn.

Energy

DePIN can enable peer-to-peer (P2P) energy trading in the energy distribution space. Instead of only distribution utilities companies trading energy, individuals and households with excess capacity can sell to neighboring homes or communities on a secure network. This network of houses can form a decentralized energy grid and bypass the need for a centralized grid provider.

A clear use case would be to develop these decentralized grids in archipelagos where islands are far apart and disjointed (like the Philippines or Indonesia). The Southeast Asia region has immense potential for generating carbon credits, given the region’s rich biodiversity and potential for renewable energy projects in hydro, solar, and geothermal - Indonesia, Malaysia and the Philippines comprise three of the world’s 17 megadiverse nations. Southeast Asia holds almost 25%r of the world’s potential for natural climate solutions, with an estimated 58% of threatened forests (or about 114 million hectares) in the region being seen as financially viable carbon credit projects. We are seeing DePIN projects (like AllInfra or the Open Forest Protocol) tackling the carbon credit market as well with decentralized carbon credit tokens, opening new supply channels.

Wireless

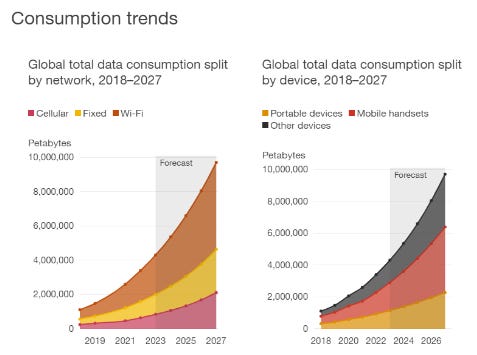

There is a large opportunity for DePIN to aid in the supply of data across mobile, fixed, and WiFi networks. Global data consumption across networks and devices are set to grow aggressively in the coming years, with the world needing differentiated solutions to satisfy this demand.

(Source: PwC, Omdia)

DePIN projects like Helium have launched to address connectivity issues by building a community-driven decentralized wireless network. Helium is one of the ‘OGs’ in the DePIN ecosystem - it was founded in 2013 to build a peer-to-peer wireless network for Internet-of-Things (IoT) devices. Helium then raised $111 million in a 2021 token sale led by a16z with participation from Ribbit Capital, Multicoin Capital, and now defunct trading firm Alameda Research. In February 2022 the project raised $200 million in a Series D round at a $1.2 billion valuation. Helium Mobile is now offering an outdoor Helium mobile hotspot for $499 and an indoor one for $249 - note that there are currently only 371k active hotspots on the Helium network. On the backend, the network incentivizes hotspot providers with the HNT token. Although valuation might be hefty compared to traction, Helium has demonstrated early product market fit for a novel attempt. Other projects like WiFi Map are launching similar efforts - the app helps users find publicly available hotspots, utilize global eSIMs, access offline maps, and much more. The project boasts 175m downloads, 15m active WiFi hotspots, and 5m monthly active users.

Services

Blockchain has also aimed to tackle services that we use daily, like ridesharing and food delivery. By utilizing bootstrapped blockchain networks, restaurant owners can band together to create decentralized delivery systems and avoid paying the 15% to 25% cut to food delivery aggregators. Similarly, ridesharing networks are characterized by app duopolies and have no room for local / grassroots coordination. DePIN projects like Nosh and Teleport are aiming to give ownership (and power) back to local communities.

Sensors

To power the DePIN revolution, independent mobile devices will need to ‘sense’ what is going on around them. The Internet of Things will empower DePIN networks to add value as sensing machines. Projects today tackle problems from noise pollution to the lack of navigation / mapping for certain areas, all the way to counting how many steps a person’s walked for the day. Though our mobile phones are powerful, they still face the challenges of having to be ‘always on’, requiring users to ‘opt in’, and dealing with data privacy issues.

Projects like Frodobots are looking to crowdsource real-world datasets with robotic gaming. Frodobots allows users to ‘play’ and operate real-life robots that gather location-based data as they traverse city streets. At the same time, users’ action labeling helps train the AI models behind the robot and can make users eligible for token rewards.

DePIN’s current challenges

Despite hype and the vast amounts of capital pumped into DePIN projects, the sector is not without its challenges. We will discuss a few key issues that DePIN will need to solve before becoming completely viable.

Technological Capabilities

DePIN will heavily rely on the integration of IoT devices and other tech to create a reliable decentralized network. As it stands, centralized solutions already encounter connectivity issues, especially in emerging markets, so it comes as no surprise that decentralized solutions that require existing infrastructure will also have a difficult time scaling. Reliability, data synchronization, and integration are problems that DePIN looks to address with its community-focused decentralized model that takes an ‘all hands on deck’ approach.

Lack of Demand / Traction and Consumer Trust

Consumers and enterprises, regardless of location, will always need clear incentives to shift data infrastructure providers. Building out a reliable, cost-effective, and legal business model is paramount to building consumer confidence. If one of these facets fails, then consumers are less likely to shift to a decentralized provider vs sticking with incumbents. The lack of demand is evident in how DePIN projects are only generating ~$18m in revenue per year. Enterprises have more stringent processes to switch from their existing providers - suppliers need to be consistent and secure. DePIN needs to prove its reliability and security, despite being the cheaper solution - Filecoin costs $0.19 / TB / month while Amazon S3 costs ~$23 / month. As Filecoin’s network gets more secure, we see more consumers and enterprises moving towards the much cheaper solution.

Economics

Because there is a lack of demand for DePIN projects, the incentive flywheels do not take off as intended. DePIN requires significant amounts of capital to kickstart its networks and bootstrap supply for the infrastructure it provides. The problem with the current market is that even after building supply, the lack of demand leads to a breakdown of the flywheel. The inherent volatility of crypto makes it hard to determine the long-term economic viability of bootstrapped DePIN projects but projects are looking to stabilize their networks to address inherent volatility. This is expected to improve when the ecosystem matures and usage increases. When projects are able to generate real revenues, the fundamentals will be able to support a more stable earn-out for network participants.

Regulatory Issues

Telecommunications infrastructure is largely regulated across markets (developed and emerging alike), with government regulations evolving rapidly. Providers of digital infrastructure will need to remain nimble to address these regulatory challenges and at the same time have an open-line with government officials. Decentralized projects may have difficulty addressing government communications and foreign ownership issues that surround digital infrastructure at the moment. Global storage projects such as Filecoin should lead the way in terms of negotiations with governments to address this issue.

Looking Ahead - Novel Crypto Primitives in DePIN

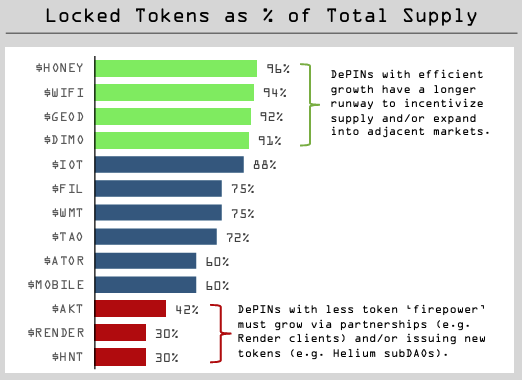

Despite the challenges mentioned above, DePIN has made significant progress in 2023. According to Messari, the industry added over 600k nodes over the past year alone. Underpinning this growth is a show of support from token holders: tokens locked as a % of total supply have increased for successful projects, giving teams more runway to incentivize supply or expansion into other markets.

(Source: DePIN Ninja, EV3)

While traditional DePIN projects figure out sustainable incentive models, we believe new DePIN projects that tackle less complex and less critical infrastructure can take off. Projects like Hivemapper have created a decentralized way to map the world and have seen good initial traction. Users around the world using their own cameras to map the world. This is a new model where decentralized solutions (people on their phones / cameras) replace centralized ones (satellite imagery, governments) to help produce something better at a quicker rate.

(Source: Hivemapper)

Less developed markets or areas of conflict with a lack of digital infrastructure like Africa and Southeast Asia stand to benefit from improved digital infrastructure. Africa has some of the most expensive internet prices in the world, with Nigeria ranked 3rd in cost / mb / s at $4.89. Centralized players find it hard to make a return on their investment without charging high rates - decentralized models have a window of opportunity to provide more competitive prices. Southeast Asia has two very large archipelago nations in the Philippines and Indonesia. Unsurprisingly, the Philippines and Indonesia rank 35th and 21st in the world in terms of internet cost. Markets like these where populations are young and tech savvy, stand to benefit from more advanced technological and economic solutions that DePIN has to offer.

Looking ahead, we see more rooms of experimentation for DePIN projects, including Zero-Knowledge, memecoins and increasingly, AI. A latest report by EV3 and Messari also expects the next top-10 DePINs to come out of Asia in 2024 - 2025.

Conclusion

The Ocular team has definitely put a pin in it and will explore trends in DePIN in subsequent posts, so do keep a lookout for them! We are excited to see how Web3 continues to evolve and improve infrastructure for corporates and consumers alike. As always, we would love to connect with anyone who is actively building in the space/shares a keen interest in discussing the latest trends in the DePIN sector - if this resonates with you, do feel free to reach out to us at crypto@ocular.vc.