Introduction

There has been a renewed wave of optimism towards web3 in light of recent events, including the approval of the long-awaited spot Bitcoin ETF; and the surge in market activity in the early months of 2024.

On the regulatory front, we have seen the conclusion of several high-profile court cases and lawsuits, including some of the charges involving Ripple and Binance. Beyond the results of the rulings (which many argue are in favour/support of web3), the resolution of these cases in itself has provided greater clarity and stability to the ecosystem.

As these events set the stage for exciting times ahead, we at Ocular wanted to share the key trends and developments that we are watching in 2024.

Macro

Besides the events mentioned in the introduction, there are a few other macro catalysts that could significantly impact web3 this year.

First, the highly-anticipated Bitcoin halving scheduled for April 2024. This refers to the reward for Bitcoin mining being cut in half, reducing the supply of new coins issued by half.

Assuming demand for Bitcoin remains unchanged, this supply shock should lead to higher prices for Bitcoin. Historically, this has been the case. Past halving events in 2012, 2016 and 2020 have heralded the onset of bull cycles, culminating in Bitcoin hitting all-time highs. If this cyclical pattern continues, we may visit new all-time highs in 2024.

Second, the potential approval of a spot Ethereum ETF, which some speculate as early as May 2024. Following the success of the spot Bitcoin ETFs - which collectively have seen roughly $5 billion in net inflows in the first month of their launch - all eyes are shifting to a potential spot Ethereum ETF approval that market participants will look to front run. We would expect to see a new wave of retail and institutional investors participating in the space, and it would also significantly broaden Ethereum's accessibility, cementing its position as a cornerstone of the decentralised ecosystem.

Third, potential interest rate cuts by the Federal Reserve, which many expect to occur in the second half of 2024. A lower interest rate environment could steer capital away from traditional safe havens into riskier assets offering higher yields, including in web3. Today, we are already seeing certain crypto assets approach all-time highs, when interest rates are slightly above 5%.

Given points two and three, we could see greater institutional involvement and risk-taking in web3 this year. The notion of institutions investing/participating in the sector is increasingly normalised, with many institutions already invested in crypto assets and initiating/supporting strategic projects. Over the past few years, institutions might have hesitated to get involved in web3 given the high-interest rate environment where alternative assets could offer high yields with less considerable risks involved. However, this may change in 2024 and given greater regulatory clarity/mainstream acceptance of crypto as an asset class, the stage is set for a potential influx of institutional funds into web3.

We will also need to keep a close watch on the US presidential elections in November 2024. While election years are generally good for markets (e.g. the S&P 500 has averaged a 7% gain during U.S. presidential election years since 1952), it remains to be seen if the candidate elected will have a favourable view towards crypto and enact pro-crypto policies. Furthermore, depending on the composition of the House and the Senate post-elections, this may shape the regulatory frameworks that the US has governing crypto, and this could impact the sector given the prominent role that the US plays.

Themes

Having noted the favourable macro backdrop, let’s dive into the micro in search of alpha.

1. Next Chapter in Layer 1 Scalability War

Lots of popular Layer 1s (L1s) today (e.g. Solana, Avalanche, Aptos, Sei etc.) are monolithic (i.e. a single chain that ensures consensus before executing the transaction). The chain itself will also store the historical data of past transactions, giving the chain its immutable property. The downside of such an approach is the lack of customisability by use case and the greater centralisation risk at scale.

Alternatively, Ethereum is going down the modular blockchain route, scaling via an army of L2s. However, modularity does not stop simply with fractal scaling but seeks to provide efficiency and flexibility by breaking blockchains into their component parts: execution, settlement and data availability. A leading example is Celestia - a “lazy ledger” which looks to provide the cheapest possible data availability component, leaving other chains to compete primarily on execution. Modularity provides more flexibility, but also opens the door to competitors looking to carve out specific components within the stack.

Besides modular blockchains, we have also observed the advent of app-specific chains. This refers to chains that focus on a particular vertical or application to serve a specific function (e.g. dYdX Chain for decentralised derivative transactions on dYdX; Ronin for gaming; and DeSo for decentralised social applications). We expect these app-specific chains to continue to grow in popularity, as it gives projects/developers full autonomy over their underlying infrastructure and can be tailored to meet certain needs.

It remains to be seen which model of L1s will survive the test of time, but our view at Ocular is that all three models will continue to feature in the sector and can exist in parallel with each other. Nonetheless, there will be consolidation within each segment, e.g. we do not envisage the need for too many general-purpose monolithic L1s and it will be hard to sustain all of them given finite liquidity. In 2024, we could see liquidity and talents start aggregating around a select handful of ecosystems with break-away network effects.

2. Development of the Restaking Flywheel

Restaking on EVM refers to the process where staked ETH can be used as cryptoeconomic security for protocols other than Ethereum, in exchange for protocol fees and rewards. The concept of restaking was introduced when EigenLayer was launched, generating much excitement within the Ethereum community.

The hype around Eigenlayer is understandable given the advantages that it brings to protocols, validators/restakers and Ethereum itself, creating a win-win-win situation.

For protocols, EigenLayer eliminates the arduous task of having to bootstrap their own trust networks. By leveraging EigenLayer, protocols can focus on enhancing their core functionalities without being encumbered by the process of building out validation systems.

Validators/restakers stand to gain substantially from EigenLayer's inception too, as it presents an opportunity to generate additional yield from their staked ETH and enables greater capital efficiency.

A flywheel is thus formed, with two primary implications. One, it will popularise the concept of liquid staking (and restaking). More users would be attracted by the high yields and flexibility accorded by this concept and we could see more platforms similar to Eigenlayer being introduced. Two, this could solidify Ethereum's dominance as the primary L1. By consistently attracting users and liquidity to the chain, Ethereum will continue to grow in strength and will remain one of the main general-purpose chains that users and developers choose to use.

There are restaking protocols popping up for other chains such as Solana, Cosmos etc. However, it is unclear whether there is similar merit to ETH restaking, as the security level and underlying chain designs are different.

3. Rise of Use Cases to Attract Web2 Users - this could be in GambleFi and memecoins …

We shared previously as part of our Token2049 reflections that for web3 to achieve mass adoption, it is vital to educate and encourage web2 users to participate in the space. The sector will have to adopt a new mental model - shifting its focus from appealing solely to existing native web3 users, to promoting and making web3 understandable to a much wider audience.

One way to attract retail users to web3 is by creating apps that pique their interest and capture their attention. This could be in the GambleFi domain, be it in the form of a decentralised casino or prediction markets for any assets. For the latter, the concept is simple - one could issue/create assets of any kind and trade those assets easily. GambleFi is an area that is easy to understand and intuitive to users (given that we have similar concepts in web2). It is also highly social, in that users can interact/coordinate actions with other asset holders, enabling projects to tap on this community aspect to boost user retention rates.

GambleFi could be an easy access point for web2 users and there are existing examples to justify this claim. As of Dec 2023, Rollbit, a platform that offers an online casino and crypto futures, reported a year-to-date revenue of $355 million, making it the third-highest web3 protocol/platform in revenue generation, only behind Uniswap and Lido. Its user base also continues to grow - on 28 Jan 2023, it announced that it generated over $1.5 million in bets in just 24 hours, smashing its previous daily revenue record.

Another example of mainstream “gambling” that is increasingly popular will be memecoins. Memecoins can be defined as a subcategory of crypto centered around popular internet memes or pop-cultural references. Often, these coins do not have an underlying technology or support any particular use case, hence they do not have any fundamental value. The value of these coins will be driven by the attention they generate and whether the community finds the story behind the coins interesting and relatable. In recent months, the mania around memecoins has grown, and today memecoins have a market cap of more than $60 billion. Given the current price action of memecoins which will feed into its virality, we expect memecoins to continue to garner significant attention and could be the gateway for new users to enter web3.

The main headwind for GambleFI and memecoins will be regulations, as policymakers may wish to deter retail investors from overly risky speculative activities. Nonetheless, if projects in these domains could meet the regulatory framework and ensure that users gamble/invest responsibly, they could be sectors to watch.

4. … or decentralised social media experiences

The explosion of friend.tech last year reminds us of the potential that decentralised social media experiences have in generating mainstream attention and catalysing the next wave of growth for web3.

This year, we expect to see even more experiments in the decentralised social media space. Amid mounting concerns over data privacy and security, users are increasingly keen to take ownership of their data and be given the autonomy to decide which platform/who to share this information with. Aware of this pain point, projects will seek to address this desire and cater to the users’ preferences. This can be seen with farcaster.xyz, which has gained significant traction since its launch - today, it is estimated that there are nearly 25,000 daily active users on the Farcaster network.

Similar to what Farcaster does, we envisage that for future iterations of such decentralised social media experiences, it would be combined with NFTs. It would be a single platform where people can flaunt, exchange and discover collectables, before connecting with other like-minded enthusiasts. It would serve as a canvas for digital self-expression, enabling users to divulge more about themselves while actively pursuing their passions and interests.

5. Upcoming Solana DeFi Summer?

There has been a flurry of DeFi activity on Solana lately, evident in how its TVL has increased by over 55% from Jan to Feb 2024. This may be unsurprising given the scale of recent airdrops in the space, e.g. Jito, which handed out over $225 million worth of its tokens to users; and Jupiter, which distributed roughly $700 million worth of its tokens to nearly a million wallets. Other projects, such as MarginFi, Drift and Kamino are also rumoured to have an airdrop later this year, fueling growing interest in Solana DeFi protocols.

Besides the increased number of users and liquidity in the Solana DeFi space, what is interesting to us are the new DeFi models/innovations that tap on the powers of the Solana blockchain to offer faster, cheaper and more efficient transactions.

Take Jupiter for example - it is a decentralised exchange (DEX) aggregator that compares the prices of tokens across various DEXes, before offering the best price to users for trades. While there are many DEX aggregators in DeFI, Jupiter takes advantage of Solana’s speed and low cost to route the orders to as many DEX markets as possible, and at the same time, dynamically split the orders into multiple smaller trades if needed to get the best prices for them. On other platforms, routing these orders to this many DEXes and calculating all possible routes for transactions will severely inflate the transaction costs and take far too long, but it is possible on Jupiter, thanks to Solana.

Another example will be Central Limit Order Book (CLOB) DEXs, such as Phoenix. CLOB is an exchange model that aggregates limit orders and matches buyers with sellers. Compared to the more popular model of Automated Market Maker (AMM), CLOB offers tighter spreads, particularly for large orders on trading pairs with limited liquidity and does not run into the issue of impermanent loss. CLOB also offers greater flexibility in customising orders, with features such as limit orders, stop losses, trailing stops, options and leverage available.

To be clear, CLOB is a model that has been around in TradFi for a while now and may be familiar to readers. However, CLOB has not been used much in DeFi as it requires the execution of many transactions, which will make it inefficient and expensive on many existing L1s. Until now. With Solana, DEXes can afford to execute these transactions without having to pass on the costs to users, and CLOB becomes a viable model in DeFi.

Given the attention on Solana DeFi and the emergence of new technologies in the space that will benefit users, we expect Solana DeFi to become increasingly popular and could spark off the next DeFi summer.

6. There are existing sectors/technologies that we believe will continue to grow in prominence - first, zero-knowledge proofs …

To recap, a zero-knowledge proof is a cryptographic protocol that allows one party to prove to another party that a given statement is true without revealing the statement itself.

There are multiple applications for this technology, including in client-side privacy. Users may not wish to share their personal information with apps or with others, and they can potentially tap on this technology to develop zero-knowledge proof/identities for themselves. This way, their full details will no longer need to be revealed, but they will be verifiable and can authenticate that it is indeed them.

Zero-knowledge proofs are also useful for scaling solutions that move computation and state off-chain into off-chain networks for time and cost savings while storing transaction data on-chain on a L1 network. They can help prove that the off-chain computation was done correctly and build trust in the scaling solutions. This will encourage more users to adopt these scaling solutions, making their web3 transactions more efficient and affordable.

Another possible use of this technology will be in Artificial Intelligence (AI), with zero-knowledge machine learning (zkML). The idea behind zkML is that the party that generates an output using an AI model will be able to generate a cryptographic proof that proves that the right AI model (with the correct set of training data and parameters) was used in the computation process.

Why is this important? Today, we interface with many AI models and we tend to implicitly trust the outputs that these models generate. For example, when we key in a query on ChatGPT or Siri, we trust that these models have been trained by the right datasets and have conducted their inference correctly. So when these models recommend a restaurant for us to check out when we search for a place to eat, we are ok to go along with it. Even if the recommendation didn't turn out great, we may boil it down to our personal preferences, rather than any possible issues with the model.

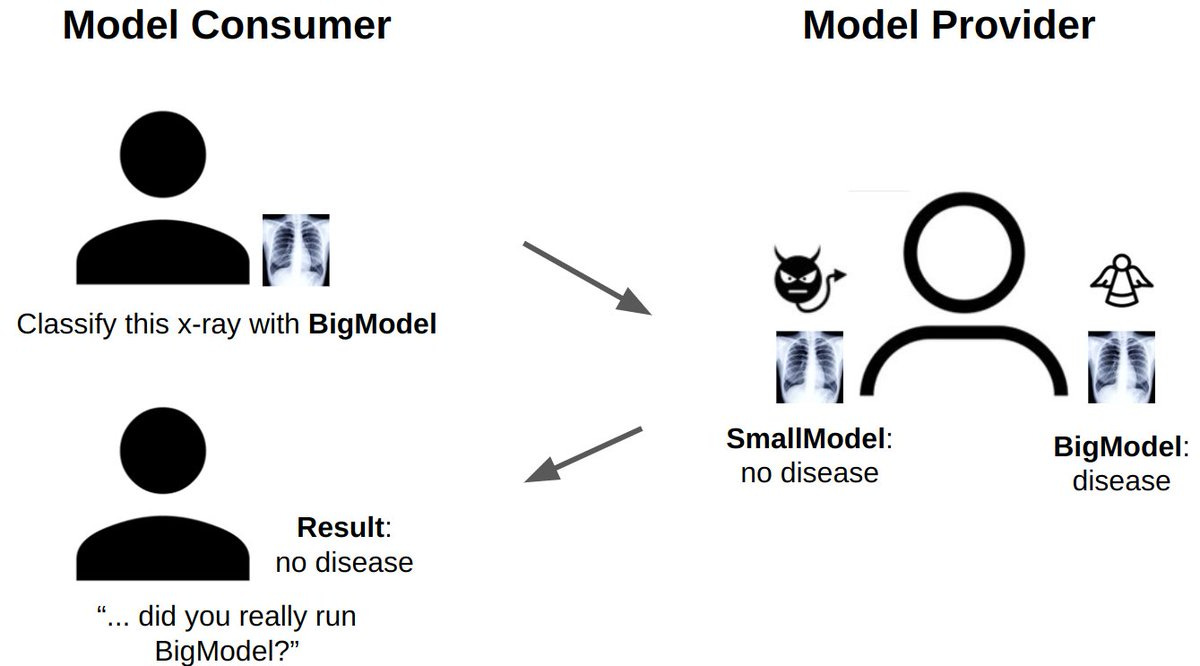

But what if the stakes were higher and we could not afford to be wrong? Think about the case where there is a healthcare AI model that is used to determine if an individual has a disease. While the output may show that there is no disease, we may not be sure if the correct model has been run - this problem is neatly summarised in the picture below. This serves as the impetus for zkML, and it is an area that we think will continue to grow as AI models become increasingly prevalent.

(Source: https://twitter.com/daniel_d_kang/status/1582519854405255168)

7. … second, decentralised physical infrastructure (DePIN)

DePIN refers to capital-intensive infrastructure projects using tokenisation to coordinate and scale in the bootstrapping phase of network development. Individuals are tasked to help build the infrastructure in a decentralised manner, and they will be rewarded with tokens for their efforts.

In 2023, the DePIN sector continued to gain traction, particularly in the areas of decentralised storage, compute and wireless network. On the latter, we note that it is starting to serve mainstream users - the developers behind Helium Network announced in Dec 2023 that they would now be offering an unlimited data, talk and text phone plan for $20 per month in the US, in collaboration with T-Mobile. Overall, the DePIN ecosystem has grown to over 650 projects, with the combined market cap of DePINs with liquid tokens exceeding $20 billion.

We are of the view that there is further room for DePIN as a sector to grow, with Asia potentially being a bright spot for this new model. There are parts of Asia where there are large populations, but digital infrastructure may be lagging or overpriced. This sets the stage for the potential disruption by DePIN to reduce the costs of rolling out the next-generation infrastructure networks in a capital-efficient and bottoms-up manner. There are already examples of DePIN projects surfacing in Asia, including IoTeX; Starpower; and Huddle01.

Conclusion

We will elaborate further on these trends in subsequent posts, so do keep a lookout for them! As we think about the year ahead, we are excited to see how web3 continues to evolve and grow. As always, we would love to connect with anyone who is actively building in the space/shares a keen interest in discussing the latest trends in the sector - if this resonates with you, do feel free to reach out to us at crypto@ocular.vc.