A dive into the world of NFTs (Part 1)

Disclaimer: All write-ups in this substack channel are Ocular Ventures’ own opinions, and should not be misconstrued as investment advice or recommendations. Ocular Ventures does not hold positions in the projects discussed in this channel, unless otherwise stated. This content is intended for informational purposes only.

Introduction

In our past few posts, we wrote extensively about cryptocurrency tokens and protocols, including Solana, Polygon and Fantom. We hope that you managed to read them! This week, we would like to shift gears slightly and discuss another area in the blockchain space that is growing increasingly popular – Non-Fungible Tokens (NFTs).

NFTs can be thought of as unique digital assets that serve as certificates of ownership for virtual or physical objects, such as art, music, collectibles or even real estate. It is non-fungible in that it cannot be interchanged for another asset of the same type. Each NFT can only have one official owner at a time and it is secured by the underlying blockchain. This means that no one can modify the record of ownership or recreate an existing NFT.

Demand for NFTs has been heating up. In the first half of 2021, NFTs generated over $2.5 billion in sales, up from just $13.7 million in the first half of 2020. In March 2021, Beeple’s NFTs titled “Everydays – The First 5000 days” also sold for a record $69.3 million, cementing Beeple’s position as one of the top three most valuable living artists. With many rushing in to purchase NFTs, it leads us to question what the hype over NFTs is really about.

This post seeks to explain NFTs in greater detail - we will discuss the history of NFTs, the different types of NFTs available and how to navigate the different platforms that offer exposure to NFTs. This will be Part 1 of a three-part series on NFTs. In Part 2 and Part 3, we will share more on gaming NFTs and the views of various NFT artists respectively, so be sure to stay tuned for it!

Background of NFTs

The concept of NFTs first started in 2012 with the inception of Coloured Coins. Coloured Coins were used to represent real-world assets ranging from subscriptions to digital collectibles on the Bitcoin blockchain and were made up of small denominations of a Bitcoin, known as Satoshis. While Coloured Coins marked a leap in the usage of Bitcoin’s blockchain, it was not as efficient as originally hoped for as Bitcoin’s scripting language was not designed to support NFTs.

In 2014, with the limitations of Bitcoin in mind, Robert Dermody, Adam Krellenstein, and Evan Wagner founded Counterparty. It was a peer-to-peer financial platform and distributed, open-source Internet protocol built on top of the Bitcoin blockchain, and allowed for the creation and issuance of assets.

Many projects subsequently began to take tap on the Counterparty platform to launch their NFT-like assets. This included Spells of Genesis in April 2015 with their in-game currency called BitCrystals, and Force of Will in April 2016, which placed their popular trading cards on the blockchain. By October 2016, memes such as the recognizable green frog Rare Pepes were issued on Counterparty.

This is what Rare Pepe looks like

With Ethereum gaining prominence in early 2017, Rare Pepes soon made its way onto Ethereum as well. Nonetheless, the first NFT project on Ethereum came in 2017 with CryptoPunks, which was founded by John Watkinson and Matt Hall. CryptoPunks consists of 10,000 unique generated characters and it is arguably the project that has inspired the modern CryptoArt movement.

This is what CryptoPunks look like

Interestingly, it is worth noting that CryptoPunks used the ERC-20 Ethereum token since ERC-721 had not yet been developed. While ERC-20 tokens are useful, they are not best suited for creating unique tokens as they were created as standardized tokens that can be fungibly shared or exchanged for other tokens.

With the emergence of NFT projects on Ethereum, Dieter Shirley (alongside William Entriken, Jacob Evans and Nastassia Sachs) proposed the ERC-721 standard [AZ1] for Ethereum tokens, which stores unique identities to track the ownership and movements of individuals tokens. The ERC-721 token was then used by Dieter himself in 2017 to co-create CryptoKitties, a blockchain game that allows players to purchase, collect, breed and sell virtual cats.

Image of CryptoKitties

CryptoKitties took the world by storm as its launch coincided with the cryptocurrency bull market in 2017. Roughly a month into its launch on November 28, 2017, its daily transaction count shot up 111% and the average transaction fee rose by 1,165%. CryptoKitties has been described as the first NFT project to gain mainstream popularity, and the rest ever since then is history.

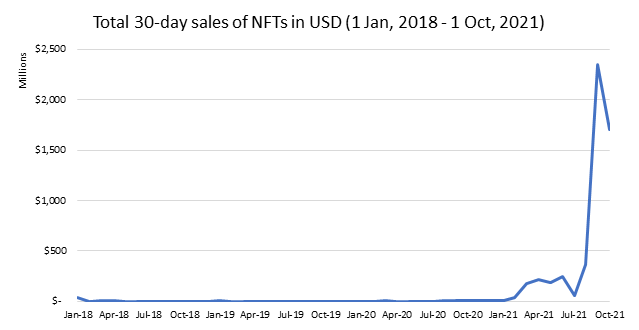

According to NonFungible, the total monthly sales on NFTs (as of 1 Oct 2021) exceeds $1.5 billion, and this is significantly higher than $33.8 million in sales done on 1 Jan 2018 (see chart below). In the same time period, the total number of active unique wallets which have bought or sold an NFT has also increased from 56,000 to over 150,000.

(Data source: NonFungible)

General public interest in NFTs has also spiked in recent years. Based on Google Trends, the term ‘NFT’ was searched most often in early September 2021, and the current search interest for the term stands at a relative score of 63, as compared to 1 a year ago in October 2020 (as depicted below). In terms of popularity by region, China, Singapore and Hong Kong have shown the greatest interest in NFTs, with Australia and the United States coming in at 7th and 8th respectively.

(Data source: Google Trends)

To summarise this section, below is a timeline summary of the key milestones for NFTs.

Where to buy NFTs

NFTs can be purchased on a peer-to-peer marketplace, which allows users to trade their NFTs. DappRadar has mapped out the top 10 most popular NFT marketplace of all-time based on trading volume on the platforms (as seen below). Some are generic marketplaces, e.g. Opensea, Rarible and Foundation, while others are targeted towards a specific type of NFT, e.g. CryptoPunks and NBA Top Shot or game, e.g. Axie Infinity and Aavegotchi.

Top 10 Marketplaces on dAppRadar

As seen with the above list, most of the marketplaces and NFTs on the platforms are built on ETH. This is unsurprising considering that Ethereum was one of the first blockchains to be established and it has created a robust ecosystem of projects and developers. In fact, Ethereum may benefit from the Lindy Effect, where we can expect it to continue to remain relevant in the future as it reaps its network effects.

While ETH is the main chain for NFTs, other chains such as Solana, BSC and Tezos are also getting into the NFT space and starting out their own marketplaces. As mentioned in our last post, Fantom also recently launched a new NFT marketplace called Artion on its blockchain. Depending on the popularity of the underlying blockchain, these marketplaces may see greater adoption over time.

Categorizing NFTs: How we like to break it down

In the wide world of NFTs, we can think about it in two key parameters – how original an NFT is, and how much utility it has to the owner. Originality ranges from super common pieces such as generative profile pictures which can range from 1,000s to 10,000s of somewhat similar pictures, to original digital art which is called “1/1s” (one of one). Whereas utility ranges from purely a JPEG to display on your social media or an online gallery, to providing utility to the owner – be it through dividends, special invites, access to other projects or more.

Non-exhaustive map of NFTs

Despite the multiple categories out there in the NFT-verse, we will be focusing on three different types of NFTs: (1) Generative Profile Pictures; (2) Original “1/1” Art; (3) Gaming. We will try to take you through the intricacies of each type, and also personal stories of participating in and buying some of these NFTs.

Generative Profile Pictures (PFPs): You think you’re unique but you aren’t

Some of the first NFTs made were profile pictures to be used on social media as avatars, and amongst the first of that category were CryptoPunks. As introduced above, this NFT came in a set of 10,000 generative profile pictures that was fed through an algorithm which created mostly common traits, but with one or two that were zombies or aliens. When it was first introduced in 2017, the NFTs were given away for free (anyone with an ETH wallet could claim one). This was back in the early days, where there were only a handful of NFTs that existed.

Fast forward to 2021, where Opensea recorded over $3.4 billion in transactions over 1.67 million NFTs. Ledger Insights reports that the makeup of transactions over this period was mostly avatar-like NFTs that hoped to emulate CryptoPunks. Given the ease at which creators can produce these generative art pieces, it’s no wonder that they would gravitate towards this category. Plus, buying generative art pieces feels like buying lootboxes on gaming sites – it’s cheap, generally 0.01 eth to 0.03 eth to mint, and there’s a sense of FOMO when you see NFTs being flipped for 10x – 100x on social sites.

There are plenty of famous PFPs that are currently trading at mind blowing prices. Just see the top 10 places on the Opensea transaction leaderboard for the past 30 days. Out of these, CryptoPunks, Bored Ape Yacht Club, Mutant Ape Yacht Club, CrypToadz, Cool Cats, Sneaky Vampire Syndicates are all PFPs that have seen huge success. Sneaky Vampire Syndicate (ranked #9), has seen transaction volumes of ~$51m over the last 30 days. What’s crazier is that it was only dropped in the middle of September which means that it has only really had 2 weeks of trading action!

Opensea top 10 NFTs by volume over last 30 days

PFPs are also very easy to get into, and don’t require a lot of research before buying them. There are even celebrities (athletes, rappers) that had PFPs as their first purchase. On August 31, basketball superstar Steph Curry shelled out 55 ETH (~$180,000) for a Bored Ape Yacht Club NFT. BAYC #7990 to be precise about which NFT he bought.

Steph Curry’s Twitter profile

Snoop Dogg, also known as @CozomoMedici, bought a CryptoPunk zombie (considered ultra rare) for 850 ETH (~$2.8 million) alongside other NFTs. To date, his collection stands at over $20 million with multiple rare pieces. He has also partnered up with The Sandbox, an upcoming multiverse game within the Ethereum blockchain, housed under the Amonica Brands family of multiverse games.

Snoop Dogg ousts himself as CozomoMedici, a whale in the NFT space

Even Mike Tyson, one of the greatest heavyweight champions of all time, is no stranger to the NFT space. He recently bought a Cool Cat NFT and has it as his Twitter profile picture.

Mike Tyson’s Twitter profile

As it stands, PFPs are a very easy way for non-crypto natives, or even non-NFT natives to get into the industry. The seemingly flippant nature of profile pictures and the excitable community existing on twitter and discord makes purchasing these NFTs fun and enjoyable.

Original “1/1” Art: You’re unique, but its slow

Unlike generative art which can be churned out at a mind-blowing speed, original “1/1” art takes slightly, if not a lot longer to produce given that each individual piece is unique. Each piece of work also is more expensive, given the amount of labor and effort going into produce one. As a result, original “1/1” art usually has a smaller set of consumers, and a higher entry price.

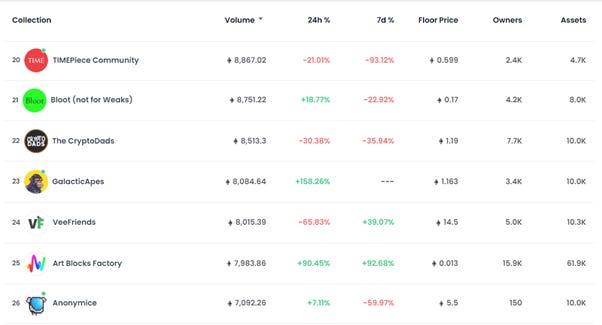

Another reason for the smaller consumer base is due to the lack of visibility on both social channels such as Twitter, as well as ranking sites such as Opensea’s “Stats” ranking page. If you were to scroll through Opensea’s ranking, you’d find the first original art at #20 with TIMEPiece Community, which is built by a group of artists that were inspired from the prompt “Building a better future” by TIME magazine.

Opensea stats ranking by volume over the last 30 days

The next original art on the list would be Gary Vaynerchuck’s VeeFriends, which is a collection of hand drawn pieces with alliterative titles. Something interesting to note here is that while the art can be considered simple, what’s driving volume and adoption (~$26 million total transacted value over the last 30 days) are two things:

1) Gary’s star power as an internet personality and CEO of VaynerMedia which has clients such as Shell, Pepsico, Unilever, Mondelez, KraftHeinz, Diageo;

2) The utility that owning a VeeFriend gives to the user. A post on the VeeFriends discord points out that each individual NFT provides the user different levels of access and activities through the smart contract attached. The NFT token is the key that unlocks the user into Gary’s world.

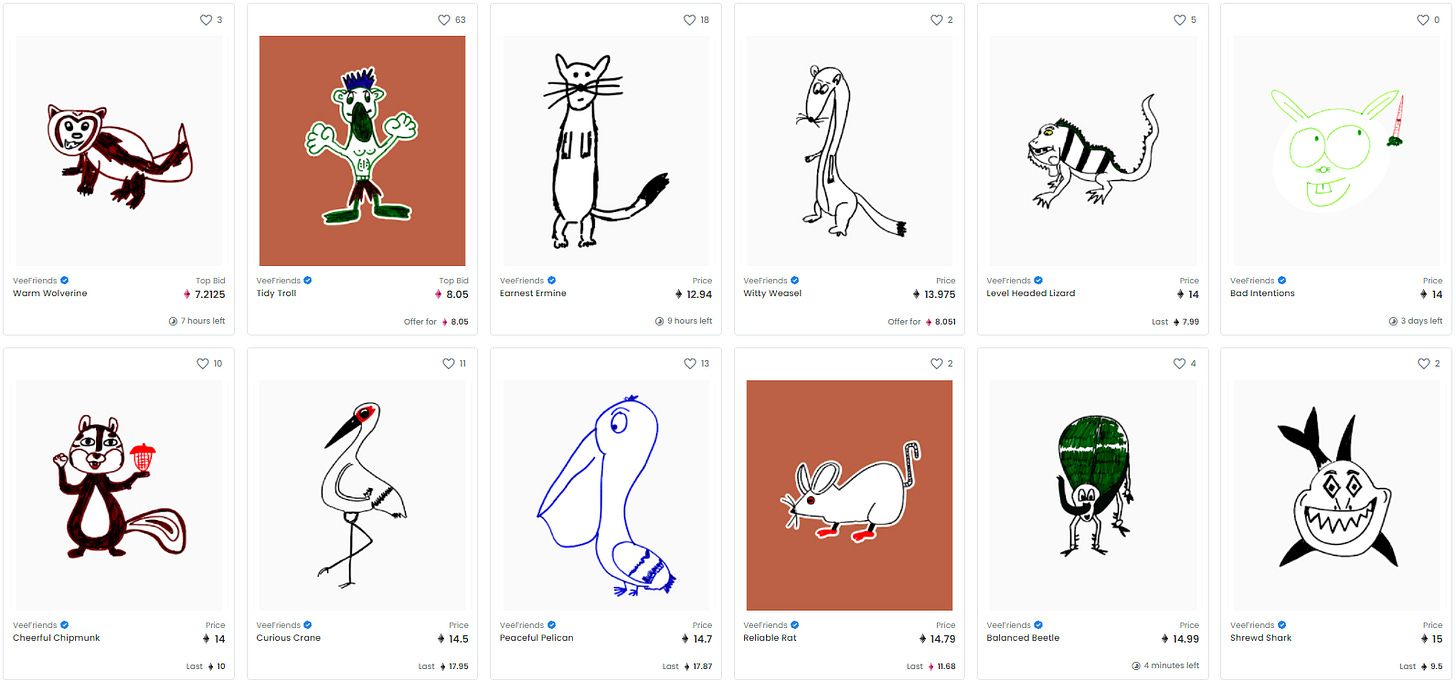

Gary Vaynerchuck’s VeeFriends Opensea listings

Utility and community play a very important role in the NFT space, and more important than in the PFP space given. This is because the NFTs are slowly released to the community, unlike in a PFP where 10,000 of NFTs can be claimed over a span of a few minutes. Therefore, the artist must consistently nurture and build up their community.

I will paraphrase an example that our main fund’s managing partner likes to use: The community is like the organs; they must be strong to have a healthy body. The utility is like the blood; it must continue to be present and circulate to have healthy organs. The means of engaging the community (games, giveaways, engagement managers) is like the glucose; it must be present to give boosts to the organs from time to time.

Having been in multiple discord channels, I’ve seen firsthand how communities get hyped for a project only for it to die 1-2 days after because there wasn’t enough community engagement. Like sales in the real world, a lack of after sales support kills retention.

But I’ve also seen vibrant communities that have continued to flourish as the artist builds out the NFT collection. Artists that employ contests like the Lxveless’ drawing contests or Bull Market Girlfriend’s giveaway contests continue to build up their community and keep them engaged as they take their time to produce their art. These contests allow new members to receive free NFT drops which ultimately would keep them engaged, while continuing to build the hype with others for a chance to win a free NFT in the future.

Lxveless quick draw contests held every 3 days

Bull Market Girlfriend’s daily raffle

An interesting point about the original “1/1” NFT projects is that they build staying power through providing utility for the owners. Owners of the NFTs are usually entitled to pre-sales, deals, and other giveaways. This creates hype around the project and usually increases the value of the NFTs over time as more consumers are made aware of the projects, while the pace of release of the NFTs is kept constant.

An example of this is the Lxveless project. The project first launched the series “Five Lxve Languages” which featured 30 pieces of each Lxve Language. Owners of the project could collect each Lxve Language, which entitled them to a special giveaway in the future. This pushed up the secondary price of the NFT as collectors were busy bidding up NFTs. The Lxveless then released “Ancient Lxves” which was 40 pieces of each type of Lxve. Again, collecting each piece of the set enabled owners to a special giveaway. Owners could also combine Lxve NFTs to receive unique pieces which enabled them to other giveaways.

As a result, the price of the NFTs has been kept consistently high, hovering around 0.5ETH – 1ETH. This is significantly above the 0.05ETH mint price which owners mint these NFTs with (minting refers to the price at which the owner buys the NFT from the artist at). Unlike PFPs which usually have floor prices (floor refers to the lowest price in the open market) similar or lower to mint prices, original “1/1” NFTs tend to have significantly higher floor prices.

Lxveless’ utility roadmap

Stay tuned to part 2 of this article, where we will continue with a dive into gaming NFTs and add some concluding remarks to this space. Part 3 of the article will focus on interviews with NFT artists to round up Ocular’s segment of the NFT space!