Understanding Polygon

Does Polygon offer the best layer-2 scaling solution? Is Polygon still relevant with ETH 2.0?

Ocular Ventures is an investment fund focused on crypto VC and HF fund investments with a discretionary pocket to invest directly in crypto projects. We are a group of crypto enthusiasts with venture capital and data science background.

We started this newsletter to share our knowledge of the latest blockchain technologies, including infrastructure protocols, DeFi, NFTs, and other dApps which are going to reinvent how things work in web2.0. We hope you will enjoy this newsletter and provide us with valuable feedback.

We aim to post every one to two weeks. Do sign up below to receive the latest updates directly in your inbox!

Disclaimer: All write-ups in this substack channel are Ocular Ventures’ own opinions, and should not be misconstrued as investment advice or recommendations. Ocular Ventures does not hold positions in the projects discussed in this channel, unless otherwise stated. This content is intended for informational purposes only.

Introduction

In our previous post (check it out here if you missed it), we wrote about Solana and how it provides a more scalable solution compared to the other layer-1 protocols, particularly ETH 1.0. Since then, Solana’s price has soared by over 144% to reach a new all-time high of $214.96. We hope that you managed to get in on the action!

While Solana and other layer-1 solutions are gaining popularity, ETH 1.0 remains the dominant blockchain. According to State of the DApps and Coin98 Analytics, around 78% of dApps are currently built on ETH 1.0 and ETH 1.0 has over 200,000 validators in its ecosystem (as compared to 2,000+ on Cardano and 900+ on Solana).

Nonetheless, the issues surrounding ETH 1.0 have yet to be resolved. ETH 1.0’s processing speed is still around 15 TPS and its fees are high, with gas prices being around 150 Gwei. Cognizant of the limitations of ETH 1.0 (and other layer-1 protocols), the blockchain community have devised a few methods to improve their scalability.

The most prominent method is known as a layer-2 solution, which refers to a network that operates and lies on top of existing layer-1 protocols. It increases the throughput and efficiency of the underlying blockchain without tampering with any of its original decentralization or security characteristics. This is done by handling transactions off the main infrastructure.

For this week’s post, we will dive deeper into the concept of layer-2 solutions and analyze some key projects. We will also address the question of whether layer-2 solutions will remain relevant after ETH 2.0 is rolled out.

Landscape of Layer-2 Solutions

There are five main types of layer-2 solutions:

Sidechains. A Sidechain is an independent blockchain that operates on its own consensus mechanism and security properties. It acts as an interoperable sister chain alongside the main chain, and assets can be moved between chains to handle various transactions.

Given the above definition, some have commented that Sidechains are not really a layer-2 solution, and rightly so. We have included this in, as we view it as a useful hybrid between a layer-1 and layer-2 solution and it was one of the first few scaling technologies introduced. Examples of public sidechains include xDai and SKALE, and some apps use their own private sidechains like Axie Infinity with Ronin.

State Channels. A State Channel is a two-way communication channel between participants that allows them to make multiple transactions off-chain and submit only two transactions to the underlying blockchain.

To use a State Channel, a portion of the blockchain is first sealed off via a multi-signature smart contract that is pre-agreed by the participants. The participants can then directly interact with each other off the main chain. It is only when the entire transaction set is over that the final state of the channel is added to the blockchain. Bitcoin’s Lightning Network and Ethereum’s Raiden Network are examples of state channels.

Commit-Chains (or Plasma specifically). Plasma leverages the power of Merkle Trees and smart contracts to create unlimited smaller versions of the underlying blockchain. These smaller chains are called child chains or Plasma chains, and they can be built on top of each other to form a tree-like structure. The child chains work together to offload bandwidth from the main blockchain, also known as the parent chain. Each child chain has its own block validation mechanism, but the child chains periodically interact with the parent chain to settle disputes and report dishonest nodes. OMG Network and Gazelle are protocols that use Plasma.

Zero-Knowledge Rollups (ZK-Rollups). ZK-rollups bundle or “roll up” multiple transactions together off-chain before generating a cryptographic proof called a SNARK (Succinct Non-interactive ARguments of Knowledge). To validate all of the transactions, only the SNARK will need to be submitted to the main blockchain and it will be used to update the state of the layer-1 protocol. Notable examples of ZK-rollups include Loopring, zkSync and StarkNet.

Optimistic Rollups. Optimistic rollups are similar to ZK-rollups in that it aggregates multiple transactions before committing them to the main blockchain. The key difference is that for Optimistic rollups, no computations are done and aggregators will only need to publish the minimum information required onto the blockchain with no proofs. Optimistic rollups assume that the transactions are legitimate by default. It is only when someone reports a fraudulent transaction that the Optimistic rollups will execute a fraud-proof to verify the transactions. Optimistic rollups are currently developed by Optimism and Offchain Labs’ Arbitrum rollup.

Using Eth1.0 as the base layer for context, each layer-2 solution type has its pros and cons.

As seen in the above table, sidechains are useful as quick fixes to the scalability issues faced by ETH 1.0 but compromise security. On the other hand, state channels and plasma are scalable and secure, but they deprioritize the speed and scope of transactions.

Both ZK-rollups and Optimistic rollups seek to address the inherent trade-offs that sidechains, state channels and plasma face. Rollups, in general, will improve the scalability of ETH 1.0, but at the same time, not neglect the security, speed and scope of transactions that can be done on the blockchain. Given its superior technology, many believe that the future of layer-2 solutions will revolve around rollup projects. Vitalik Buterin, the co-founder of Ethereum, himself envisions a rollup-centric Ethereum future.

Introducing Polygon

While many projects are working on layer-2 solutions, we would like to highlight Polygon, as it has attracted significant attention from developers and retail investors since the beginning of 2021. In fact, Polygon’s YTD ROI has exceeded 8,000%.

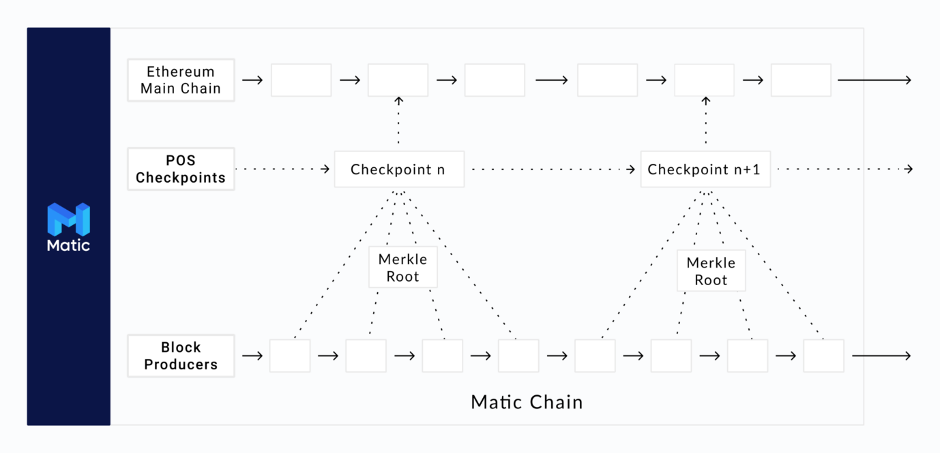

Polygon was started in 2017 by four software engineers – Jaynti Kanani, Sandeep Nailwal, Anurag Arjun, and Mihailo Bjelic – and it was originally called the MATIC network. It aims to address the pain points associated with layer-1 solutions, including high gas fees and slow speeds, without sacrificing security. At first, Polygon (or the MATIC network) offered scaling solutions for Ethereum through its own Proof-of-Stake (PoS) chain and Plasma framework. This is also known as the Polygon Commit Chain, which is built on the Ethereum network, as seen below. For a more detailed description of the workings of the Polygon Commit Chain, do refer to this video.

(Source: Stacked Crypto)

Subsequently, in Feb 2021, MATIC underwent a rebranding and renamed itself as Polygon, in tandem with a shift in vision. Polygon now wants to be an aggregator of all scalable solutions on Ethereum and provide a framework for developers to build and connect all Ethereum-compatible blockchain networks. We will expand more on Polygon’s products in the subsequent sections.

Polygon’s native token is still called MATIC. At the time of writing, MATIC is priced at $1.42, giving it a market cap of $9.4 billion. There is a circulating supply of 6.65 billion MATIC, out of a total supply of 10 billion MATIC. The chart below provides the breakdown of MATIC token supply distribution.

(Data Source: Binance Research)

Polygon has three key advantages:

Polygon supports a variety of layer-2 solution types, giving users the flexibility to decide on the right tool for them without having to compromise speed or cost.

There are multiple use cases on Polygon, highlighting its relevance to a wide variety of sectors and creating new expansion opportunities.

Polygon has experienced growing adoption over time, resulting in the development of a robust ecosystem and equipping Polygon with network effects that it can tap on.

Aggregator of Layer-2 Solution Types

What if we told you that all five layer-2 solution types introduced above can be found in a single project and you can pick and choose the ideal solution type based on your demands? Well, that is what Polygon is promising.

In line with the term ‘poly’ in Polygon’s name, Polygon is looking to present a suite of solutions to Ethereum’s scalability issues. While it still deals primarily with sidechain connectivity and taps on the Plasma framework, it plans to expand its toolbox to include other layer-2 solutions. Currently, it has incorporated ZK-rollups (through the acquisition of Hermez) and will be adding on Optimistic rollups, Validum chains, application-specific chains, enterprise chains and interchain communication protocols shortly. Given so, Polygon has described itself as a Swiss Army knife of Ethereum scaling and infrastructure development. These solutions are packaged in a modular format, so users can plug and play depending on their needs.

With Polygon, projects will be able to build blockchains that combines the best features of standalone blockchains (sovereignty, scalability and flexibility) and Ethereum (security and developer experience). It promises to resolve the scalability trilemma that has hampered Ethereum. In addition, Polygon is compatible with Ethereum, allowing these blockchains to tap on existing Ethereum tools and communicate with each other as well as with Ethereum.

Thus far, Polygon has proven useful in scaling Ethereum through its increased throughput. Polygon can do up to 65,000 TPS on its chain, which is significantly higher than the 15 TPS that ETH 1.0 currently achieves. Polygon has also reduced the high transaction fees associated with ETH 1.0, as seen below (figures are correct as of 10 Sep 2021).

(Source: Polygon)

Moving forward, Polygon hopes to expand beyond Ethereum and enable other blockchains to adopt its solutions. This means that we could see other layer-1 protocols using Polygon and there will be interoperability between chains, allowing for a scalable multi-chain ecosystem.

Use Cases

Multiple projects spanning various sectors have embraced Polygon. There are over 500 dApps using Polygon’s scaling solutions, accounting for over $500 million in transactions. This graphic summarizes all the projects on Polygon and provides the breakdown by key sectors.

Some of the top projects on Polygon include Curve, the largest DEX by TVL at $12.8 billion and Aave, the largest lending DeFi platform by TVL at $14.1 billion. Other notable examples in the DeFi space include SushiSwap, QuickSwap and Zapper.

Popular games like REVV Racing, PolyBlades and Meeb Master are on Polygon. Polygon has also partnered and invested in Decentral Games to inspire the next wave of “play-to-earn” games on the platform, such as Axie Infinity. As for NFTs, Polygon currently powers OpenSea and Aavegotchi. On 27 Aug, Dolce & Gabbana announced that they will be producing and releasing a nine-piece NFT fashion collection. The drop will take place on UNXD, a curated marketplace for digital luxury and culture, which (as you may have guessed) runs on Polygon.

Growing Adoption

There is an increasing number of developers and users adopting Polygon, as seen with the total number of addresses and transactions on Polygon as well as TVL of the chain.

Number of addresses. As of end-Aug 2021, the total number of addresses on Polygon has passed 50 million. While Polygon still lags BSC by about 40 million addresses, it is growing at a much faster pace and is likely to catch up soon. As seen with the chart below, there are about 550,000 new addresses per day on Polygon as compared to 200,000 and 102,000 new addresses per day on BSC and Ethereum respectively.

(Source: Coin98 Analytics)

Number of transactions. Over the past 3 months, Polygon has consistently amassed about 6.5 million transactions per day. This is significantly higher than Ethereum’s average throughput of 1.2 million transactions per day and is comparable with BSC’s average throughput of 7.9 million transactions per day (although BSC’s numbers fluctuate wildly and at times, Polygon have exceeded BSC in transactions).

Using the number of addresses and transactions, we note that Polygon’s daily transaction ratio per address is significantly higher than that of Ethereum and BSC since Polygon has fewer addresses, and this indicates more active participants on Polygon’s network.

(Source: Coin98 Analytics)

TVL. Polygon is currently the 5th largest chain by TVL. Its TVL exceeds that of Avalanche ($2.13 billion) and Fantom ($1.71 billion), correct as of 10 Sep 2021.

(Data source: DeFi Llama)

In line with Polygon’s popularity, the price of Polygon’s token has been steadily on the rise in the last two months. It reached its all-time high in May 2021 and while there has been a slight dip since then, it has grown by about 20% in the last month.

(Data Source: CoinMarketCap. Price stated per day is based on close price, i.e. latest data in range – UTC time)

Polygon has also garnered significant institutional interest and is backed by Binance and Coinbase. In Jun 2021, the Polygon ecosystem received a major funding boost, as it announced a $21 million joint venture fund with blockchain venture capitalist AU21 capital. The funds will be used to build new projects on Polygon and to support developers.

Risks and Threats

We have identified four main risks and threats that Polygon will have to manage, should they wish to remain relevant in the future.

Development of ETH 2.0. Ethereum, as we are aware, is undergoing a series of upgrades to improve its scalability, security and sustainability. The first phase of ETH 2.0, the Beacon Chain, was launched in Dec 2020 and the third and last phase of ETH 2.0, the Shard chains, is expected to be ready in 2022. With the Shard chains in place, Eth 2.0 is set to become 64 times more scalable than ETH 1.0, and this has led to questions on the future of layer-2 solutions.

Some have argued that ETH 2.0 may render layer-2 solutions redundant, especially since layer-2 solutions currently face issues of limited composability, liquidity and onboarding and offboarding friction. While these issues may be fixed, users may prefer the convenience of sticking with a single platform, i.e. ETH 2.0, instead of having to shuffle through various layer-2 solutions.

Here at Ocular, we take a more moderated view of the situation. We note that the full implementation of ETH 2.0 will take time and the endeavor of transitioning a large established protocol like ETH is risky in itself, without any guarantees of success. In the meantime, the scalability issues of ETH 1.0 will need to be addressed and layer-2 solutions will help to plug the gap.

In addition, once ETH 2.0 is rolled out, it may not fully address its scalability issues. While ETH 2.0’s throughput may increase by 64x, demand is likely to increase exponentially as well as more users move to web3.0, and ETH 2.0 may not be able to cope with the increased traffic. The magnitude and complexity of the scalability trilemma call for a multi-pronged approach, rather than a single situation. Given so, we believe that there is enough space in the ecosystem for both ETH 2.0 and layer-2 solutions to co-exist and complement each other.

Rollups. As shared earlier, rollups (both ZK-rollups and Optimistic rollups) are at the forefront of layer-2 solutions. Due to its superior technology, rollups may be the most popular layer-2 solution amongst users.

While we are cognizant of this risk and acknowledge rollups’ potential, we see them as developing technologies without much traction yet. For Optimistic rollups, Optimism and Offchain Labs’ Arbitrum had only recently published their solutions on the mainnet in Jul 2021 and Aug 2021 respectively. For ZK-rollups, zkSync 2.0 had only made available its public testnet in Jun 2021, and it is not on the mainnet yet.

In terms of usage, Optimism and Arbitrum has a TVL of $127.6 million and $22.9 million respectively, which lags behind Polygon ($4.7 billion). Optimism and Arbitrum also currently process about 50,000 and 15,000 daily transactions respectively, which is much lower than Polygon (6.5 million). Given the infancy of these rollup projects, it is uncertain whether they will be able to live up to their billings and be widely adopted.

In any case, we note that Polygon will also be adopting rollups in their toolkit and are well-positioned to tap on and benefit from any developments in this area. Furthermore, Polygon’s key strength is that it is an aggregator of layer-2 solutions, which provides users with the flexibility to choose the right solution for their needs. Users may prefer the options that a generic project like Polygon offers, instead of having to pick and stick with a particular solution type.

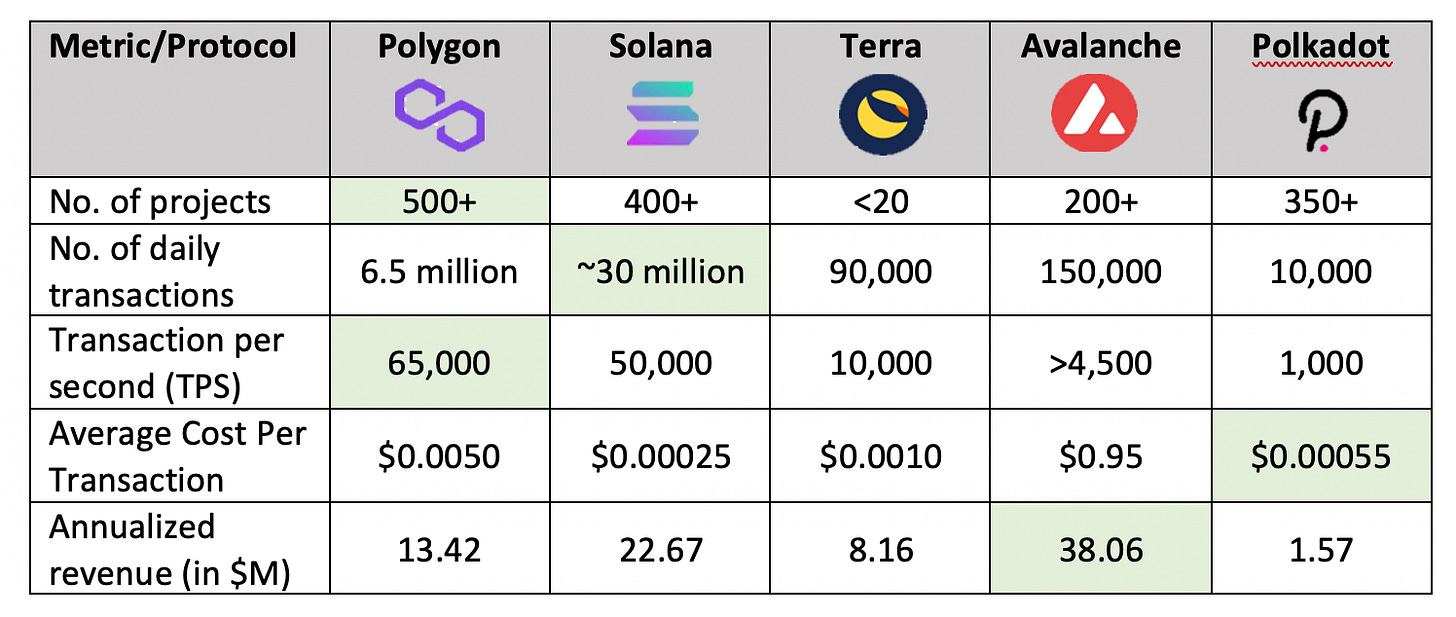

Other layer-1 solutions. Ethereum’s scalability issues have led to the rise of many layer-1 alternatives. These options promise faster transactions without compromising on security, and users may choose to utilize these chains instead. Some of the more popular Ethereum-compatible chains which may pose a threat to layer-2 solutions include Solana, Terra, Avalanche and Polkadot.

While the layer-1 alternatives have gained traction lately, we see as of 10 Sep 2021 that the number of projects and daily transactions on Polygon exceeds most of the other chains due to its exceptionally high TPS. The cost per transaction on Polygon is slightly higher than its peers but remains low. Consequently, Polygon is generating a healthy annualized revenue. Polygon seems to have built up a defensible technology and has managed to reap some network effects.

Centralization. Currently, over 55% of staked MATIC are owned by three entities, with Binance owning about 28%. This has led to concerns that Polygon may be overly centralized and possess a higher security risk, given that the three entities could come together to launch a 51% attack on the network.

Here at Ocular, we will continue to keep a close watch on Polygon’s staking numbers. As more users adopt Polygon, the breakdown of the staked MATIC may change as well. More importantly, we believe that it is unlikely for the three entities to collude and sabotage the network, as their investments will also be undermined should anything happen to Polygon. In addition, Binance is a well-known entity in the blockchain ecosystem and any undesirable actions on their part will adversely impact their reputation and standing in the community.

Conclusion

Taking all of the above into consideration, we are of the view that layer-2 solutions are here to stay even with the introduction of ETH 2.0. As Vitalik writes, “it seems very plausible to me that when phase 2 (of Ethereum) finally comes, essentially no one will care about it.”

In particular, rollups appear to be the most suitable solution to address Ethereum’s scalability issues. Vitalik himself admitted that in the near future, “everyone will have already adapted to a rollup-centric world whether we like it or not, and by that point it will be easier to continue down that path than to try to bring everyone back to the base chain for no clear benefit and a 20-100x reduction in scalability.”

While there are projects that focus solely on rollups such as zkSync, Optimism and Offchain Labs’ Arbitrum, we believe that users may prefer a versatile solution like Polygon which offers a wide range of options, including rollups. Polygon can also be used in a variety of sectors (as seen with its use cases) and adoption rates have been on a steady increase, making it a promising pick out of all layer-2 projects.

Furthermore, despite its meteoric rise since the start of 2021, Polygon seems to remain reasonably priced. Its market cap to TVL ratio stands at 1.84, which is significantly lower (or better) than its peers such as BSC (3.82), Solana (6.40) and Avalanche (4.65). While not without execution risks and challenges, we believe that there is room for Polygon to continue to grow and scale, and we are bullish about its prospects.