The Ethereum Merge: Past, Present and Future

The below report is from the Focal Point Series produced by Ocular.vc - a Singapore-based web3 VC focused on early-stage investing. If you find this informative, please check out our other write-ups and subscribe!

— Twitter @notdegenamy

Background

The much anticipated Ethereum Merge is upon us - on September 15 UTC, Ethereum mainnet will be merging with the proof-of-stake consensus layer, the Beacon Chain. The Beacon Chain was created on December 1, 2020, and has since existed as a separate blockchain to Mainnet, running in parallel.

This will be one of the most significant upgrades in Ethereum’s history, and took years of research and development.

The Merge will transition Ethereum into a more “green” protocol with much lower energy consumption. The Merge is the first step of a series of upgrades towards higher throughput and scalability. As outlined in Vitalik Buterin’s updated Ethereum roadmap, other upgrades include the Surge, Verge, Purge and Splurge.

Read till the end to find out what they mean.

Source: Ethereum Foundation

What are proof-of-work (PoW) and proof-of-stake (PoS)?

Since its launch in July 2015, Ethereum has used PoW consensus mechanism, similar to Bitcoin, where miners have to purchase expensive computing equipment (such as ASICs mining machines) to solve complicated mathematical problems and earn rewards for securing the chain. In essence, miners prove they have capital at risk by expending energy. Under PoS, validators explicitly stake their capital (ETH) into a smart contract on Ethereum, which acts as collateral that can be “slashed” if the validator behaves dishonestly or lazily. The validator is then responsible for checking that new blocks propagated over the network are valid and occasionally creating and propagating new blocks themselves.

Post merge, a full node will comprise of an execution node and a consensus node, with an engine API in the middle responsible for communication.

Why the change?

Ethereum is moving off of PoW to PoS because it is more secure, less energy-intensive, and better for implementing new scaling solutions.

When is the ETH Merge taking place?

After multiple rounds of tests performed on shadow forks and testnets (Ropsten, Sepolia and Goerli), the ETH Merge will take place at Mainnet Block Height 15,540,293 when Ethereum Mainnet hits the Terminal Total Difficulty (TTD) value of 58750000000000000000000.

The Merge will occur in two steps, Bellatrix consensus layer upgrade and Paris execution layer upgrade:

Consensus Layer Upgrade (Bellatrix): 19:34 on 6 September, 2022 (GMT+8) >>>Completed

Implementation Layer Upgrade (Paris): countdown here

What do users and dApps have to do?

The Merge will not cause any downtime, users do not have to do anything additional to secure their funds.

It will have minimal impact on smart contract and dApp developers, but the Merge does come with changes to consensus and certain changes to the application layer, which devs should pay attention to:

block structure

slot/block timing

opcode changes

sources of on-chain randomness

concept of safe head and finalized blocks

Key changes after switching to PoS

Energy consumption

As there is no longer a need to operate electricity-consuming equipment to solve mathematical problems, energy consumption in PoS will reduce by 99.95% compared to PoW. With PoS enabled, the energy cost for Ethereum is just running a node—about 2.6 MWh per year. This makes Ethereum a significantly more environmentally friendly chain, and positions ETH well for ESG-sensitive institutional investors.

Issuance of new ETH

Currently under PoW, new ETH is issued from two sources:

Mining rewards on the execution layer (i.e. Mainnet): ~13,500 ETH/day (about 2.08 ETH per block of 13.3s)

Staking rewards on the consensus layer (i.e. Beacon Chain): ~1,700 ETH/day with about 14m ETH staked

After The Merge, issuance from the execution layer (#1) will go to zero, as validators do not have to purchase expensive hardware and pay high electricity costs, reducing the monetary incentive needed to secure the network. This means the issuance will reduce by ~90%, the amount of issuance reduction Bitcoin can only reach after 3 halving events. Therefore, PoS is often considered “the triple halving” event for ETH as shown in the below table. Additionally, PoS validators do not have as much pressure to sell block rewards to cover operating costs.

Current # of ETH supply: 120.5m

On August 5 2021, EIP-1559 was passed: instead of paying the entire transaction fees to the miners, the base fee would be burnt. At gas of 17 Gwei and above, the burn could exceed issuance and therefore resulting in ETH supply being deflationary, which is extremely bullish for the ETH price.

Assumed average gas: 17 Gwei

Gas fees & speed

The ETH Merge is a change of consensus mechanism, not an expansion of network capacity, and will not result in significantly lower gas fees.

Post the Merge, block times will reduce from 13.3 seconds to 12 seconds, translating into 10% increase in speed and reduction in fees. Users are unlikely to notice any significant differences.

Most of the speed improvement and fee reduction will be achieved on rollups and Layer 2s, not yet on Layer 1 till sharding is in effect sometime in 2023.

Staking rewards

Current ETH stakers receive ~4.1% APY. Post merger, this APY is estimated by J.P. Morgan to increase to ~8.5% as stakers start to also collect transaction fees previously captured by miners. Yield earned on staked ETH does not compound, but stakers can choose to stake the rewards back into the pool.

Withdrawals

To ensure network stability, it is not possible for stakers to immediately withdraw their ETH after the Merge goes through successfully. Withdrawals are planned for the Shanghai upgrade, the next major upgrade 6-12 months following the Merge. This means that newly issued ETH, though accumulating on the Beacon Chain, will remain locked and illiquid for at least 6-12 months following The Merge. That being said, validators will have immediate access to fee tips/Miner Extractible Value (MEV), which are not newly issued ETH.

There is also a withdrawal/deposit queue that allows a maximum of 43,200 ETH unlocked per day. This is to prevent an exodus or an attacker being able to withdraw their stake quickly, acting as another layer of protection for the network.

Network security: 51% attack

A 51% attack is a type of attack on a decentralized network where a group gains control of the majority of nodes. This would allow them to defraud the blockchain by reversing transactions and double spending the native token. In PoW, once miners command 51% of the mining capacity, they can perform a 51% attack until more mining power comes onboard, which generally takes time due to the physical setup requirements. It could also be difficult to identify the exact attacker. In PoS, there will be more transparency as the network will know the address of the attacking validator. The community could fork the chain and remove the attacking validator from the system, effectively burning their stake and reducing the ETH supply.

The incentive for attacking PoS is much lower than PoW. PoW attacks require a high amount of computation power, and after the attack they can direct the computing power somewhere else, or can attack the network over and over again till they lose 51%. If a large malicious party wants to do that, it is possible, and there is less skin in the game. For PoS, the attacker has to put up a significant amount of capital to buy out 51% of staked ETH and control 51% of validator nodes, and be prepared to lose everything after the network is attacked as price will likely plummet.

However, in PoW no one can be forked out of their own chain, PoS validators can theoretically collude and fork someone else out.

Maximum extractable value (MEV) after POS

The process of determining which transactions and what order is known as “block building”. Under PoW, “block building” - proposing and confirming a block - are all handled by the miners. Because mining requires specialized tools and knowledge, a small set of mining pool operators are responsible for the vast majority of block construction on PoW Ethereum, therefore extracting value for themselves through the process.

Flashbots estimates that over $670m MEV has been capture since beginning of 2020 on Ethereum.

Post Merge, a new set of actors is created - Block Builders. These Block Builders are specialist providers that will compete in a real-time marketplace to perform block construction on behalf of validators. This mean there will be separation between Block Builders and Proposers, and this will be codified in the network under what is known as the Proposer/Builder Separation (PBS).

This means that value will accrue more to validators and stakers. There is also possibility that wallets get paid by Block Builders to route transactions exclusively, in turn wallets pay users to use their wallets.

Future upgrades

The Merge is just part of the roadmap of a series of Ethereum upgrades, according to Vitalik Buterin’s “What Happens after the Merge”. The other key phases include the Surge, Verge, Purge and Splurge, together scaling Ethereum towards ~100,000 transactions per second.

Source: @vitalik.eth

Note that these are not stages but all happening in parallel.

Surge - Danksharding + rollups

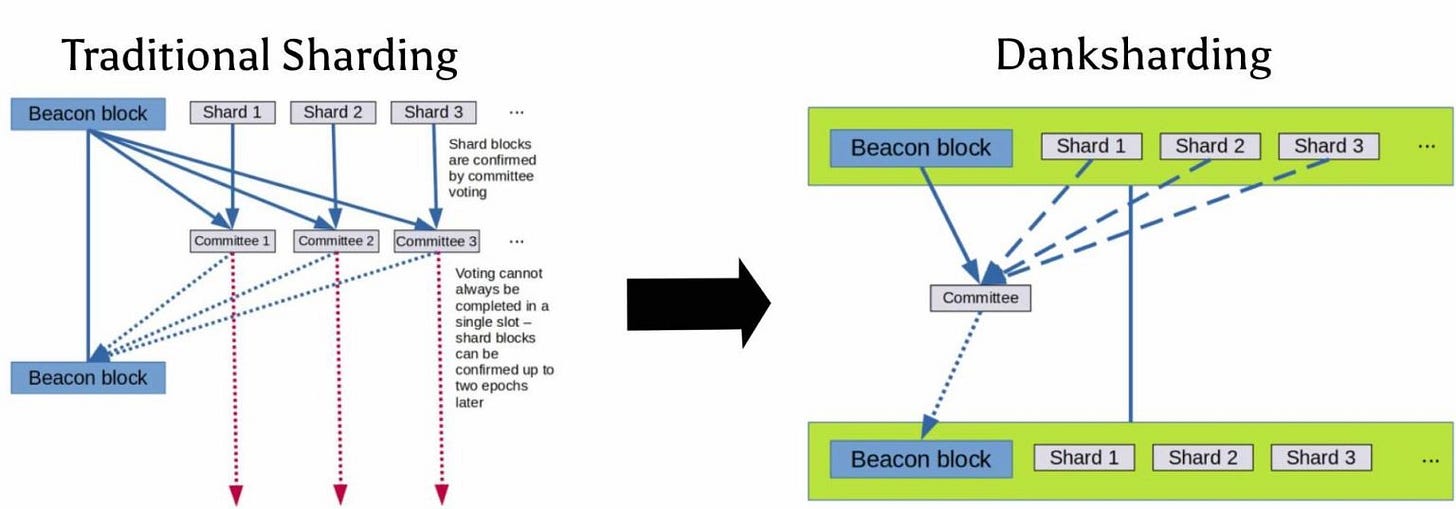

Sharding will be an important scaling solution after the Merge. With sharding, validators will no longer be required to store all of this data themselves, but instead can use data techniques to confirm that the data has been made available by the network as a whole. This drastically reduces the cost of storing data on Layer 1 by reducing hardware requirements.

The 1st version of shard chains will only be responsible for data availability, but will not handle transactions. The 2nd version of shard chains will be able to also execute code and incorporate smart contracts. At the initial stage, throughput will be significantly increased with the launch of Proto-Danksharding (PDS) via EIP-4844. This is an interim step towards full Danksharding, which will increase throughput by additional orders of magnitude.

The Surge will concurrently focus on increasing scalability through Layer 2 rollups. Shard blocks will have big ‘blobs’ of data used by the Layer 2s to drive significantly greater scalable throughput, with Ethereum Layer 1 providing security.

Source: Dankrad Feist, Ethereum Foundation (Ethereum Research)

Verge

The Verge converts from Merkle Trees to Verkle Trees, which will allow for more simple validation of blocks and blockchain. This will optimize storage and reduce node size, ultimately increasing scalability.

Purge

The Purge reduces the hard drive space needed for validators. This eliminates historical data and bad debt, streamlines storage, which in turn reduces network congestion.

Splurge

These are miscellaneous upgrades that should simplify the use of Ethereum and make it more accessible to an average user.

Risks

Potential PoW fork (ETHW)

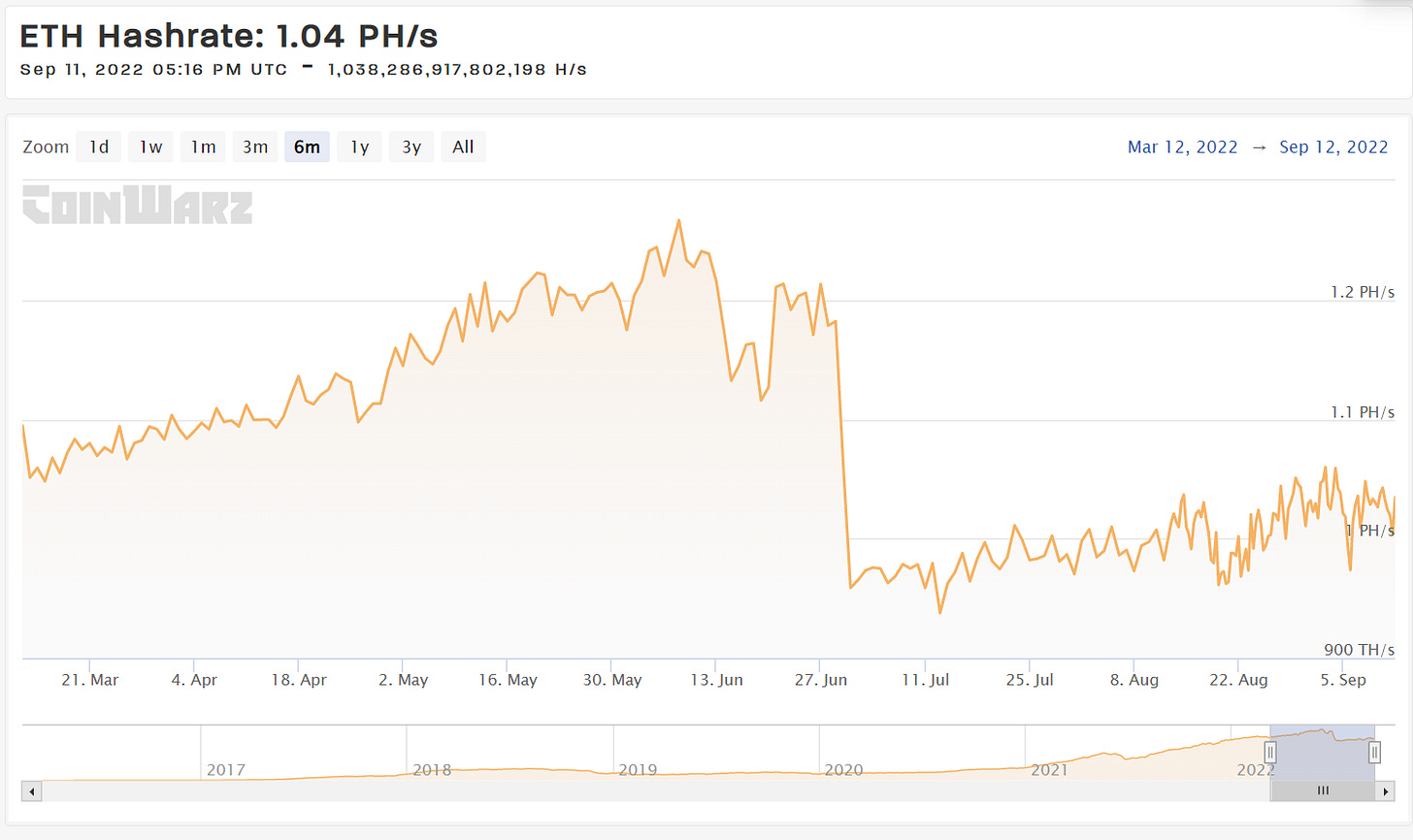

After the Merge, existing Ethereum miners will have to either switch to being validators or shut down. To put their expensive equipment to productive use, some of them have already switched to mining ETC (Ethereum Classic) instead, as seen from the drop of ETH hashrate, and significant increase of ETC hashrate:

Source: Coinwarz

Although most of the existing projects on Ethereum have indicated support of the PoS chain, Chandler Guo, one of the most prominent crypto miners, has proposed that miners continue to validate and add blocks to the current PoW Ethereum chain post-Merge.

This so-called contentious hard fork would keep the current Ethereum PoW chain alive, which Guo and supporters have termed EthereumPoW, with its native token being $ETHW. Holders of ETH ahead of the Merge will receive 1:1 ETHW after the potential fork. Binance has already expressed support for the potential ETHW airdrop and listed the ETHW future ahead of the Merge.

It is to be seen how much support EthereumPoW will gather. And the Ethereum foundation and the large community’s interest is for there to be a single chain where all the activities take place - PoS. Ethereum will seek to implement the Difficulty Bomb: a mechanism intended to incentivize the network to move away from proof of work by exponentially increasing the difficulty level of puzzles required for mining - making continued mining unviable.

Concentration of validators

To participate as a validator under PoS, a user will need to lock up 32 ETH, run commands on validator software, generate and manage their own private keys. For users who are not able to meet the minimum requirements to run their own validator nodes, staking-as-a-service is available via several platforms, which aggregate stakes and take a percentage of the yield.

According to a recent report by Nansen, top 5 staking services control 64% of staked ETH.

Lido has emerged as the largest staking platform for ETH. There are currently 14.4m ETH staked in total, and Lido accounts for ~31% according to Dune Analytics and Nansen’s report. This number could increase over time, which causes concerns over concentration of Ethereum validators, and Ethereum’s ability to resist censorship.

“Attending” the Merge

🥳 Ethereum Merge Viewing Party - Ethereum Foundation

Thursday, September 15 @ 11am Singapore Time