Ocular Invests into Mighty Bear's New Crypto Game Series

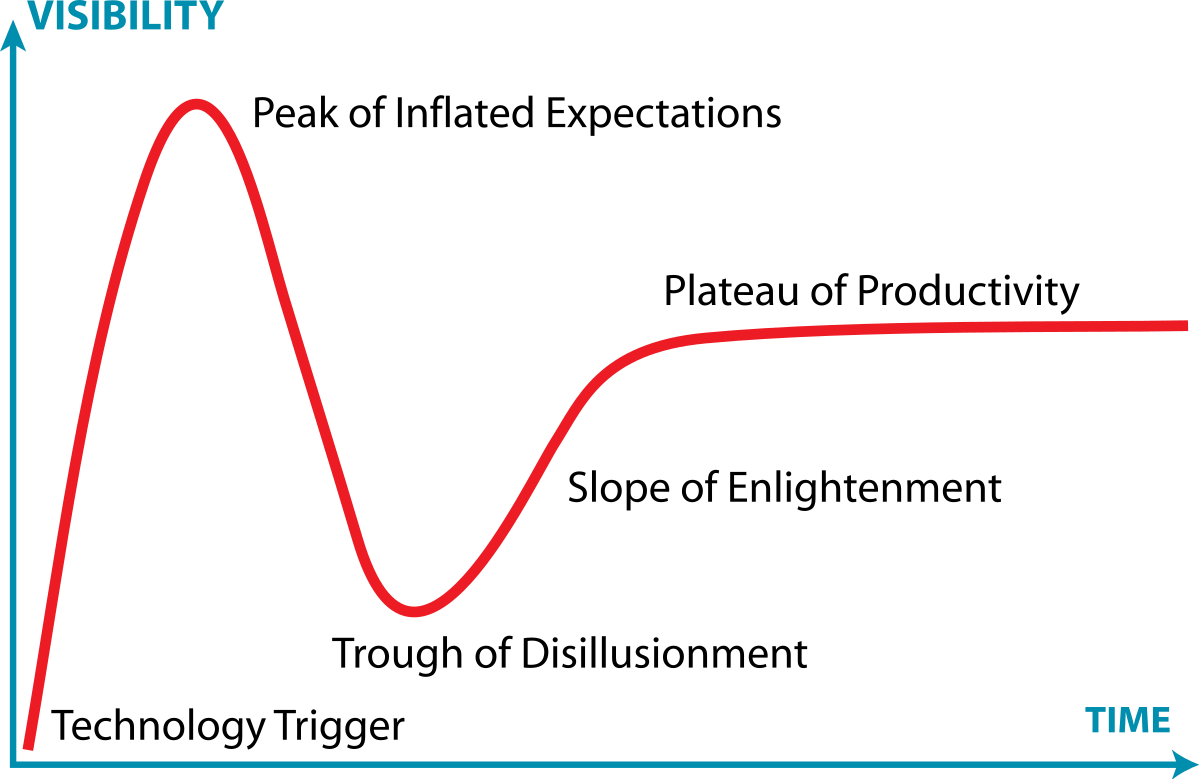

In the 1960s, Roy Amara, a Stanford computer scientist, told colleagues that he believed that “we overestimate the impact of technology in the short-term and underestimate the effect in the long run.” Since then, there have been many variations of the same phrase popularized by people like Arthur C. Clarke, Tony Robbins, Peter Drucker or Bill Gates. And there’s a good reason why Amara’s Law have been appropriated by many thinkers – because indeed, we tend to overestimate what can happen in the short term and underestimate what can happen in the long term. There is even a curve describing this observation in the tech space: The Gartner Hype Cycle

Gartner Hype Cycle (Source: Wikipedia)

Crypto gaming experienced its rise to the first Peak of Inflated Expectations in the past 18 months. Since we first started working on and observing crypto gaming back in 2017 up until 2020, crypto gaming was still a relatively niche segment within either gaming or crypto. It served mainly 2 groups of users: (1) gamblers who wanted an unregulated channel to gamble (that’s why there is a gambling vertical tracked by Dappradar for the longest time) and (2) true crypto-gamers. Guess what, there were not that many in the second category, but those guys were hard-core believers who were in it for fun or somewhat religious fun.

No. of blockchain game users and transaction volume in 2H2020 (Source: DAppRadar)

In 2021, crypto gaming caught up significantly when the DeFi hype was subsiding, and companies started infusing finance into gaming as a way to attract “mining”. Hence the GameFi concept was popularized in early 2021 with Axie Infinity holding the torch, marching from one high to another. The game indeed brought millions of non crypto native folks into a new paradigm where they could make a living. Some argued Play-to-Earn (P2E) a true innovation, while skeptics pointed out various similarities to pyramid schemes. Some praised P2E for creating jobs and banking the unbanked; while critics are pointing to the exact opposite as Axie fell into its own Trough of Disillusionment. Each side has its own merits, but we pick up several lessons learnt along the way.

Axie Infinity’s Market Cap and Revenue (Source: token terminal_)

While the current version of crypto gaming is not perfect, many of its components are anything from subtle to true innovation. Those components include (1) the application of NFT to tokenize in-game assets, giving true ownership of digital assets to gamers regardless of the faith of the game developers, (2) the use of tokenomics & NFT sales to bootstrap project development and ramp up user growth, and (3) most importantly, the introduction of a new gaming value chain where gaming distributors do not hold the ultimate power, something similar to what DeFi promises to TradFi. Perhaps the last point is also a dilemma playing out at some incumbent game makers / distributors. E.g. Steam and Minecraft are not fond of the idea so much since their metrics are often about competitive moat, retention and LTV which tend to be drained away when their ecosystems are opened up.

The rise and fall of Axie Infinity and the second generation of crypto games in the past 18 months could be a bug but could also be a feature of the last cycle that will inspire the next generation crypto game developers to keep working on and refining crypto gameplay. The number of GameFi projects continues growing (though not as fast as it used to be). Investors’ appetite remains relatively strong with c. US$4.1 billion of capital pouring into GameFi in 1H2022. New and ever larger gaming funds were launched, e.g. a16z launched a US$600 million gaming-focused fund in May, Immutable launched a US$500 million web3.0 gaming venture fund in June.

No. of crypto gaming projects launched (Source: Footprint Analytics (@KikiSmith), Binance Research)

GameFi funds raised (Source: Footprint Analytics (@KikiSmith), Binance Research)

Pleasantly, we feel that many traditional gaming companies are heading the crypto way. NCSoft Corp announced in Nov 2021 that it will unveil NFT-based, play-to-earn games in 2022. Square Enix sold US$300 million worth of valuable IP to fund its blockchain initiatives in May 2022; Epic Games raised US$2 billion to develop its metaverse efforts in April 2022. Ubisoft, EA, and Tencent have also entered the blockchain gaming space, albeit to different extents. These traditional companies are more likely to take relatively more measured approach toward blockchain uses, but will definitely bring in lots of game development experience to drive the next phase of the market.

Adoption S-curve illustrating various generations of NFT games (Source: Nansen)

At Ocular, we believe that the next generation of crypto games must achieve the right balance between gameplay and financialization, (vs. having tokenomics and earning at the center of the gameplay like today). Games need to be designed in a non-extractive spirit, i.e. they need to be fun and enjoyable first while earning is a component supplementing such purpose. Unfortunately, there is no exact formula to achieve that and the process will require a lot of testing. After all, creating a good and fun game is no easy task (see gaming’s very steep power law curve), let alone fixing a new category of gaming. As such, instead of backing strong crypto native teams doing games for the first time, we want to support strong studios which have experience making good games, the conviction in crypto gaming and the courage to stay and solve the existing problems despite another winter coming.

With this thesis, we found Mighty Bear (actually, some of us have known Simon and his team for over 4 years). They are definitely one of the strongest studios in SEA that we know, comprising of industry veterans with experience at the likes of King, Ubisoft, Lucasarts, Disney and Gameloft. The team has a proven track record of developing highly engaging games that appeal to universal audiences. And guess what! Despite having a good web2 gaming business, the Mighty Bear team form their conviction around how crypto gaming will be the future and transition themselves into a 100% crypto gaming studio.

As part of this pivot, the company also raised US$10 million funding led by Framework Ventures with participation of several gaming and crypto native funds including Ocular. Last week, Mighty Bear unveiled the first of its crypto battle royale game series: Mighty Action Heroes. We don’t want to go too much into the game details but if you are interested, do watch out for more updates here: @playmightyhero. (The game is still in development but will be launched very soon). We wish the Mighty Bear team a successful game launch and more fruits to come as they embark on the Web3.0 journey.

Best,

Ocular Team